Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Welcome to our study room! Here you will find all the resources you need to succeed in your

accountancy training. From video lectures and recorded webinars, to practice problems and quizzes, our study room has everything you need to master the material. You can also join our forum to interact with other students and instructors, and access additional reading materials and resources.

Check out Our syllabus section which provides a detailed overview of the topics covered in

our accountancy training course

Financial Accounting

This covers the basic principles of financial accounting, including the accounting equation, the balance sheet, the income statement, and the statement of cash flows

Managerial Accounting

This covers the principles of managerial accounting, including cost-volume-profit analysis, budgeting, and variance analysis

Taxation

This covers the principles of taxation, including federal income tax, state and local taxes, and international tax

Auditing

This covers the principles of auditing, including internal controls, audit planning, and audit

procedures

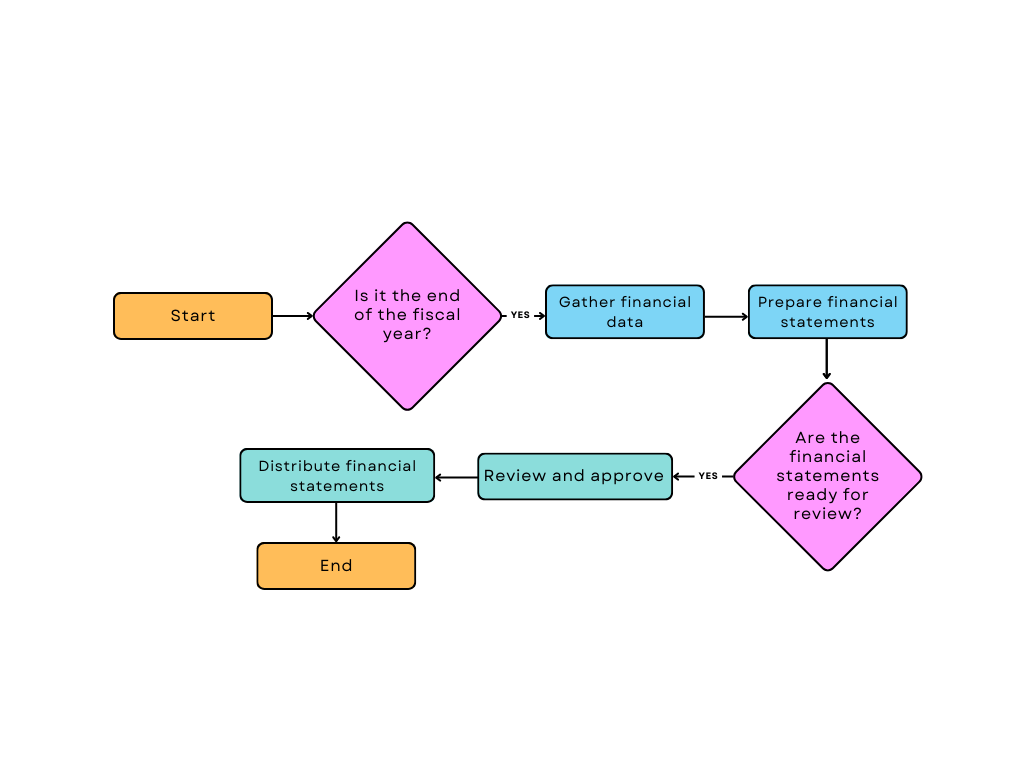

Financial Statements

This covers the preparation and analysis of financial statements, including the balance sheet,

income statement, and statement of cash flows

Financial Management

This covers the principles of financial management, including time value of money, risk and

return, and capital budgeting

Cost Accounting

This covers the principles of cost accounting, including cost behavior, cost-volume-profit

analysis, and budgeting

Accounting Information Systems

This covers the principles of accounting information systems, including systems design, controls, and data analysis

Accounting Ethics

This covers the principles of accounting ethics, including professional conduct, fraud, and

ethical decision-making

Financial accounting is the process of identifying, measuring, and communicating financial information about an organization. It is an essential aspect of running a business and is used to create financial statements such as balance sheets, income statements, and statement of cash flows. This information is used by investors, creditors, and other stakeholders to evaluate the financial performance of an organization.

It is the foundation of financial accounting. It states that assets are equal to liabilities plus equity. This equation is used to create the balance sheet, which is a financial statement that shows a company’s

financial position at a specific point in time. The balance sheet is divided into two sections: assets and liabilities. Assets are resources that a company owns, such as cash, property, and equipment. Liabilities are obligations that a company owes, such as loans and accounts payable. Equity represents the

residual interest in the assets of a company after liabilities are deducted.

It is another important financial statement used in financial accounting. It shows a company’s financial performance over a specific period of time, such as a month or a year. The income statement is

divided into two sections: revenues and expenses. Revenues are the income that a company earns, such as sales and interest income. Expenses are the costs that a company incurs, such as cost of goods sold and operating expenses. The difference between revenues and expenses is the company’s net income or net loss

It is a financial statement that shows a company’s cash inflows and outflows over a specific period of time. It is divided into three sections: cash flows from operating activities, cash flows from investing

activities, and cash flows from financing activities. Operating activities include cash transactions that are related to the company’s main

ABC Company is a small retail business that specializes in selling outdoor gear. The owner, Jane, has been running the business for 5 years and has recently decided to expand her operations by opening a second location. In order to secure a loan from the bank, Jane needs to provide financial statements that show the financial performance of her company.

The first financial statement that Jane prepares is the balance sheet. The balance sheet shows the financial position of the company at a specific point in time. The assets section of the balance sheet includes cash, accounts receivable, inventory, and equipment. The liabilities section includes accounts payable, loans, and taxes. The equity section includes the owner’s investment and retained earnings.

The next financial statement that Jane prepares is the income statement. The income statement shows the financial performance of the company over a specific period of time. The income statement includes revenues, such as sales and interest income, and expenses, such as cost of goods sold and operating expenses. The difference between revenues and expenses is the company’s net income or net loss.

Finally, Jane prepares a statement of cash flows. The statement of cash flows shows the company’s cash inflows and outflows over a specific period of time. The statement of cash flows is divided into three sections: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Operating activities include cash transactions that are related to the company’s main operations, such as cash received from customers and cash paid to suppliers. Investing activities include cash transactions that are related to the company’s investments, such as buying or selling equipment. Financing activities include cash transactions that are related to the company’s financing, such as taking out a loan or issuing stock.

Based on the financial statements, Jane is able to demonstrate to the bank that her company is financially stable and has a positive cash flow, which helps her secure the loan she needs to open a second location.

This case study illustrates how financial statements, such as the balance sheet, income statement and statement of cash flow, are important tools for measuring and